If you’re looking for auto insurance, Digit Car Insurance might be a great choice. They offer a variety of coverage types, including comprehensive insurance and custom IDV. They also have a cashless claim facility and a network of over 1,400 garages. Let’s take a look at the company’s pros and cons.

Offers liability insurance

Liability insurance is necessary for drivers to protect themselves from legal issues and liabilities. Digit Car Insurance offers this insurance. The company assists customers when they encounter any vehicle faults. This policy also includes towing facilities and medical coordination. The company will handle all these matters if the insured vehicle is locked.

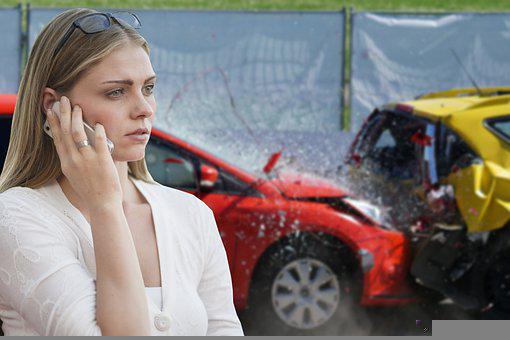

In case of accidents, customers can claim Digit’s website. The company will reimburse the expenses incurred by the insured party. Furthermore, the company will arrange cashless repair at network garages.

Comprehensive Plan

A comprehensive plan from Digit car insurance is ideal for people who want to cover the cost of repairs and replacements in the event of an accident. This plan is available online and has several benefits. For example, it offers a comprehensive policy and third-party insurance, which is essential in case of theft. Another benefit is its simple claim process. All you need to do is fill out the claim form online, and it’s done within minutes. Another great feature of Digit car insurance is its cashless garage network, which has more than five thousand outlets and is available for customers.

In addition, the policy can be renewed online. For this, the customer must enter the car’s details and the previous insurance policy. After filling up the form, the company will give you a quote that will include the premium amount. The next step is to select a plan and add-ons. This way, you can choose the level of coverage you want and the deductible you want. Then, you can set up your IDV.

Cashless claim facility

If you’re in an accident and need to make a claim, you can use the Digit Car Insurance Cashless claim facility. This service allows you to make a claim online, and Digit will handle everything from bill settlement to the repair of your car. In addition, it covers a wide range of damages not covered by a standard policy. The Cashless claim facility works at over 6,900 network garages across the country.

The process for making a cashless claim is simple and fast. First, you need to call the insurance company’s toll-free number. The company will send you a link, and you’ll need to provide your vehicle’s registration number and photo. Once you submit the information, the company will decide what type of repair is necessary. You can choose cashless or traditional repairs, and the insurance company will process the claim.

Network of 1,400 garages

If you have a car damaged in a car accident and don’t want to spend much on repairs, the Digit Car Insurance Network of 1,400 garage locations can help. The company offers doorstep pick-up and drop and repairs with a six-month warranty. The company is backed by Fairfax Holdings and offers features like zero depreciation, engine protection, return-to-invoice cover, standalone third-party liability cover, and regular exclusions. In addition, you can take advantage of their cashless service at over 1,400 garages across the country.

Digit car insurance is known for its hassle-free claims process. In addition, it offers a network of cashless garages, a free pickup and drop facility, and six-month repairs guarantee. The policy also includes personal accident coverage for the driver and co-passengers. Additionally, it also offers the convenience of an instant car inspection.

Does not cover damage to the tire

Unlike comprehensive car insurance, Digit Car Insurance does not cover damage to your tire unless you cause it yourself. Your standard car insurance policy covers damage to your tire when you cause it or if you hit something that causes damage to your tire. However, with a Tyre Protect Cover policy, you can get comprehensive coverage for tire cuts and other damages that you may cause to your tire. The damage is excluded from comprehensive car insurance, but you can get a lower premium if you choose a lower group.

Your Digit Car Insurance policy will cover damage to your tire only if you cause it, and the company provides you with a towing service if you need it. The company will also help you find a local legal advice if needed.